Processing unstructured is very important but difficult if you are an engineer you know the hassles. Splunk’s platform manages complexity and chaos efficiently in an ever-changing data landscape that enables the users to find insights from their data without first having to structure that data.

Users are particularly very much impressed is its improved mobile and natural language processing capabilities where the company is opening the aperture to a larger number of business users. The main difference between the enterprise and the cloud version is that the latter offers dynamic data management. Splunk can literally collect and index any machine data, search and analyze in real time and offers Mission-critical performance, scale and reliability.

#Splk seeking alpha free

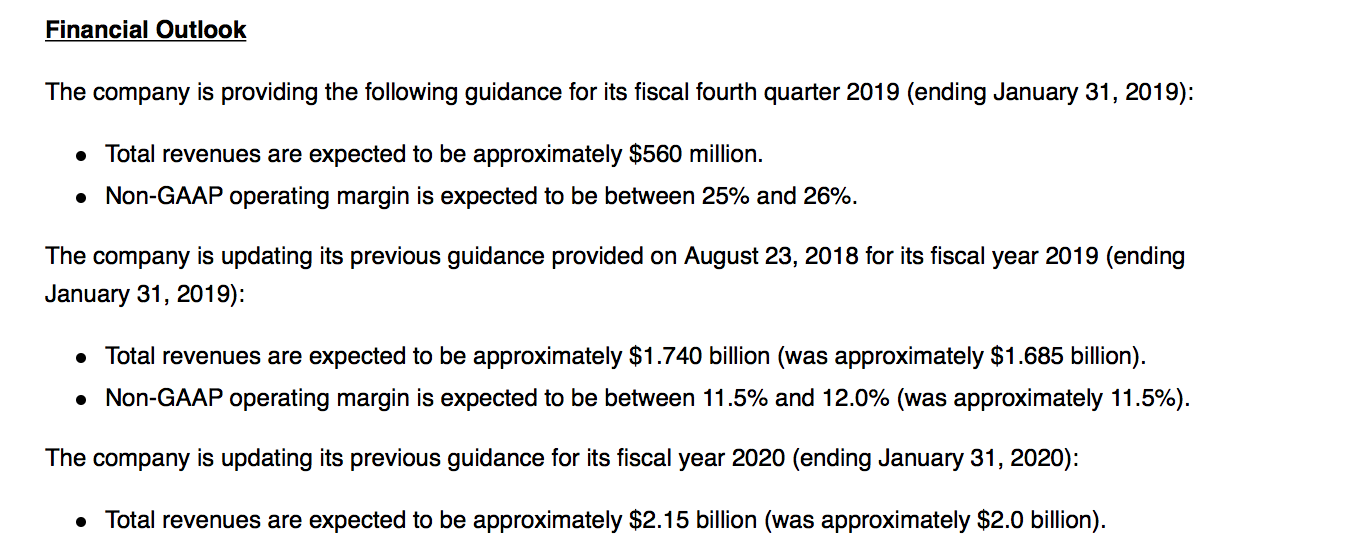

Splunk offers four levels of service, starting from a free to a light version, an enterprise version, and a cloud version. The stock has very recently taken a pullback and offers a beautiful entry opportunity at $122.įigure: Seeking Alpha Attributes that make Splunk standout Splunk went public in 2013 and consistently produced superb results since.

#Splk seeking alpha software

As a result, TrueCar instantly had all their real-time insights in one place which accelerated its software and product development and helped improve its security insights and threat detection. Consider the example of TrueCar- a platform for retrieving automotive pricing and related information, the firm needed a solution to scale and support its cross-functional searching and reporting to manage its complex IT environment, so it brought in Splunk.

#Splk seeking alpha install

Splunk’s integrated artificial intelligence enables the users to automatically detect anomalies, predict future outcomes and sift through the noise, saving companies the time and cost to install and maintain expensive data infrastructures and enabling them to focus on more important things- like making critical business decisions. Splunk ( NASDAQ: SPLK) Inc is a cutting edge firm in the field of machine data. Market Gap Up SPY had a large positive gap on the day of +1.A revolutionary platform for managing enterprise data Splunk Announces $1 Billion Investment from Silver Lake (2, 8:30 AM Business Wire) Splunk Launches New Security Cloud (2, 8:00 AM Business Wire) Papa Johns and Splunk Power Pizza's Busiest Time of the Year (1, 8:00 AM Business Wire)ĬEOs of SPLK, XTMIF, SOFI and LQAVF Unleashing Disruptive Innovation and Explosive Revenue Growth in Metaverse, Cloud Computing, Big Data and Fintech (1, 10:40 AM Globe Newswire) Market Gap Up SPY had a large positive gap on the day of +1.6% Splunk gains amid standstill agreement with investor Hellman & Friedman (1, 12:00 AM Seeking Alpha) Market Gap Up SPY had a large positive gap on the day of +1.8% Market Gap Up SPY had a large positive gap on the day of +2.3% Market Gap Up SPY had a large positive gap on the day of +3.7% Market Gap Up SPY had a large positive gap on the day of +1.5% Market Gap Up SPY had a large positive gap on the day of +2.8% Overall in the 12 available observations, the stock drifted higher 58% of the time for an average gain of +0.4%.Ĭancel Stock Price Performance - 12 Largest Positive Opening Gaps When the stock lost -3.6% after the stock gapped up +3.3%. The worst worst return from the opening price to the closing price was on 1 The best performance in SPLK stock price from opening price to closing price (referred to as the "drift" for the day) was on 1įor a +4.6% gain after the stock gapped up +8.4% at the open. On average, the SPLK stock price gain from the opening price to the highest point of the day was +2.8%,Īnd the average drop to the lowest point was -2.2%. While the biggest drop from the open to the low was -6.2% on 1. The largest percentage gain from the open to the high of the day was +5.3% on 1, The stock was down 58% of the time in that period one day after these significant gaps.Įarnings dates have been excluded from this analysis.ħ of SPLK's 12 largest moves corresponded with a large gap up in the overall market.Ģ of the moves coincided with a company-issued press release. The following day, SPLK stock price averaged -0.6% losses, In SPLK stock, the average move was +5.1% with the single largest opening gap of +8.5%įollowing the opening, SPLK tended to drift higher to the closing price 58% of the time for an average gain of +0.4%. Using the 12 largest gap-up moves over the last 3 years How does SPLK usually behave after a large gap-up move?

0 kommentar(er)

0 kommentar(er)